However, you can also apply the same tax withholding structure for your gambling winnings that you apply to other types of income. The income tax rate is 24% on all types of gambling profits, but there are certain sources of these winnings that are automatically subject to withholding tax. According to Pennsylvania law, the 36 percent tax is assessed on 'gross sports gaming revenue,' which is defined as the amount of money placed in bets minus the cash that is paid back to winners. If a casino's hold is 5 percent, it retains $5 for every $100 bet. Pennsylvania has become a mini-Las Vegas with 12 casinos along with poker rooms and sportsbooks. It only charges a 3.07% tax rate on gambling wins. What If You Win in a State That Taxes Casino Winnings? Only nine states let you off the hook regarding income tax on winnings. Odds are, you live in a state that taxes gambling profits. File Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on the type of gambling, the amount of the gambling winnings, and generally the ratio of the winnings to the wager. File Form W-2G with the IRS. Thus, for nonresidents, all gambling winnings over $5,000 and which are subject to federal withholding are also subject to New York State tax, starting for tax year 2019. See the Instructions for Form IT-203 Nonresident and Part-Year Resident Income Tax Return, page 3. The tax bulletin you refer to needs to be updated.

- Pennsylvania Tax On Gambling Winnings

- Does Pennsylvania Tax Gambling Winnings

- Pennsylvania State Tax On Gambling Winnings

- Pa Local Tax Gambling Winnings

- Year Pennsylvania Regulated Gambling: Horse racing (1963), Lottery (1972), Bingo (1981), Slot Casinos (2004), Table Games (2010)

- Estimated Tax Revenue from Gambling: $2.8 billion

- Estimated Gambling Revenue: $6.8 billion

- Pennsylvania Gambling Age: 18 for lottery, bingo, and racing, 21 for casinos

- Smoking ban: Pennsylvania permits casinos to set aside a percentage of the floor for smoking areas

- Online gambling status: Horse racing is the only form of legal online gambling

Pennsylvania is the second largest casino state in terms of gambling revenue. Most of the state's casinos are racetracks with attached casinos. There are three resort-style Pennsylvania casinos. Those offer fewer slots than the main gaming establishments in the state. This is unusual compared to most other states where casinos offer amenities. Most Pennsylvania casinos offer little more than gambling on slots, video poker, and table games.

Casinos are not the only forms of Pennsylvania gambling within the state. There is a state lottery that sells instant games and holds lotto drawings. There are live horse racing and off-track betting. Charities may hold limit games of chance to raise funds.

Paying Gambling Taxes in Pennsylvania

Do you have to pay taxes on your gambling winnings? OnlineUnitedStatesCasinos has gathered everything you need to know about paying taxes on your gambling winnings straight from a Certified Public Accountant. For more information please visit our exclusive Gambling Taxes article.

Pennsylvania Casinos Map & Guide

- Harrah's

- Parx Casino

- Rivers Casino

- Sands Bethlehem

- Sugarhouse Casino

- Number of B&M Casinos: 12

- Number of Poker Rooms: 10

- Number of Indian Casinos: 0

- Huge Welcome Bonus Package

- Visa and MasterCard Payment Options Available for US Players

- Over 150 Real Money Online Slot Games

Compatible with:- windows

- apple

- android

- mobile

- Safe and Reputable Casino, Mobile Friendly

- Easy Credit Card Deposits for US Players

- Impressive Welcome Bonuses up to 260% match

Compatible with:- windows

- apple

- android

- mobile

- Quick USA Payouts, Credit Cards Accepted

- Great Selection of Slots & Table Games

- Legit & Reputable Mobile Friendly Casino

Compatible with:- windows

- apple

- android

- mobile

- Uses the Microgaming Software

- Fast Cashouts in Just 1-7 Days

- Online, Mobile, Instant & Live Play

Deposit Options include:- visa

- mastercard

- paypal

- neteller

100% up to €1,000- Big Jackpots and Massive Deposit Bonuses

- Over 400 Online Casino Games

- Play Live Dealer Games

Deposit Options include:- visa

- mastercard

- paypal

- bitcoin

100% up to €1,600- Large Australian Bitcoin-Friendly Casino

- Mobile, Flash, and Download Play Options

- Fastest Payouts

Deposit Options include:- visa

- mastercard

- paypal

- neteller

- Safe and Trustworthy Australian Casino

- Multiple Daily Deposit Deals

- 100s of Pokies, Slots, and Table Games

Compatible with:- windows

- apple

- android

- mobile

Types of Pennsylvania Online Gambling Allowed

There is only one form of legalized online Pennsylvania gambling. That is off-track betting on horses. Sites like TVG, TwinSpires, and XpressBet partnered with Pennsylvania tracks to offer this service over the Internet and on mobile apps.

Daily fantasy sports sites claim to be legal in Pennsylvania. There is no law on the books that expressly states that. The companies claim to be skill gaming sites. There are bills under consideration by the Pennsylvania Legislature that would make daily fantasy sports a regulated and legal activity. DraftKings, FanDuel, CBS Sports, and Yahoo! are among the sites that accept Pennsylvania players. Harrahs laughlin poker room.

Types of Live Pennsylvania Gambling

- Slots: Yes

- Blackjack: Yes

- Poker: Yes

- Craps/Roulette: Yes

- Horses: Yes

- Lottery: Yes

Pennsylvania gambling offers nearly every form of betting they want in the state. Pennsylvania casinos started out only offering slots, video poker, and electronic table games. That expanded to live poker, blackjack, craps, roulette, and nearly any house-banked card game one can imagine. There are 12 Pennsylvania casinos with one more in the planning stage.

There are seven racetracks in Pennsylvania. These offer live racing and race books. These tracks moved into the casino business. That helped keep the racing industry above water.

The Pennsylvania Lottery sells scratch-off tickets and lotto drawings. These are available at thousands of convenience stores across the state. There are Pennsylvania-only lotto drawings that include Pick 2, Pick 3, Pick 4, Pick 5, Cash4 Life, Cash5, and Match 6. The Pennsylvania Lottery also participates in multi-state lottery drawings. These are Powerball and Mega Millions.

Bingo is permissible if spread by a charity. There are more than a dozen licensed bingo halls in the state.

Pennsylvania Gambling Laws

The Pennsylvania Gaming Control Board is permitted to issue 14 casino licenses. Seven were guaranteed to the state's racetracks. There were five standalone Pennsylvania casino licenses awarded. Two resorts receive licensure. A third resort will receive a license in 2017 to bring the total to 15 Pennsylvania casinos within its borders.

Casinos in Pennsylvania pay a tax rate of 55 percent on slots, video poker, and electronic table games. Live poker and table games have a tax rate of 16 percent.

Charities may apply for a bingo license. These cost $100 and are active for one year. Bingo games may have no prize larger than $250 for a single game except for the jackpot drawing. That bingo game may have a $2,000 prize pool. The largest amount of money that may be awarded in one day by a bingo charity is $4,000. Bingo halls may not spread more than two nights of action a week. Exceptions are made for charities that only hold annual celebrations. These nonprofit groups can hold 10 consecutive days of bingo games.

The Pennsylvania Lottery may only spread two types of games. One is instant games, sometimes referred to as scratch-off tickets. The other is lotto drawings. The Pennsylvania Lottery holds its own drawings as well as joins multi-state pools.

Horse racing is active in Pennsylvania. Seven tracks are licensed to offer live races. Each has a race book. Horse racing tracks may partner with online betting apps for remote wagering. Players may make deposits and withdrawals at the partner tracks.

The minimum Pennsylvania gambling age is 18 years of age, except for casinos, where the minimum gambling age is 21. Bingo participants may be under 18 if accompanied by an adult.

List of Pennsylvania Casinos

There are 12 Pennsylvania casinos open and currently operating. Seven are at racetracks that also offer live and simulcast betting, and the rest are casino resorts.

| Racino | Size | Address | Website |

|---|---|---|---|

| Harrah's – Philadelphia | 2,000 Slot Machines | 777 Harrah's Blvd. | www.caesars.com |

| Hollywood Casino at Penn National Race Course – Grantville | 2,450 Slot Machines | 777 Hollywood Blvd. | www.hollywoodpnrc.com |

| Lady Luck Casino – Farmington | 600 Slot Machines | 4067 National Pike | www.isleofcapricasinos.com |

| Mohegan Sun Pocono – Plains Township | 2,300 Slot Machines | 1280 Pennsylvania 315 | www.mohegansunpocono.com |

| Mt. Airy Casino – Mount Pocono | 1,800 Slot Machines | 312 Woodland Rd. | www.mountairycasino.com |

| Parx Casino & Racing – Bensalem | 3,500 Slot Machines | 2999 Street Rd. | www.parxcasino.com |

| Presque Isles Downs – Erie | 1,700 Slot Machines | 8199 Perry Hw | www.presqueisledowns.com |

| Rivers Casino – Pittsburgh | 2,900 Slot Machines | 777 Casino Dr. | www.riverscasino.com |

| Sands Casino – Bethlehem | 3,000 Slot Machines | 77 Sands Blvd. | www.pasands.com |

| SugarHouse Casino – Philadelphia | 1,600 Slot Machines | 1001 N. Delaware Ave. | www.sugarhousecasino.com |

| The Meadows Racetrack & Casino – Washington | 3,000 Slot Machines | 210 Racetrack Rd. | www.meadowsgaming.com |

| Valley Forge Casino – King of Prussia | 600 Slot Machines | 1160 1st Ave. | www.vfcasino.com |

History of Pennsylvania Gambling

Horse racing was the first form of legalized gambling in Pennsylvania. Its regulation started in 1964. The racing industry dated back more than 200 years before that. Dozens of tracks operated off the book races where the betting was handled through underground networks. It took until 1964 for the state to determine it was better off regulating and taxing the racing industry than to let it operate without any oversight.

The Pennsylvania Lottery was created by Act 91 on August 26, 1971. The first lottery ticket was sold on March 7, 1972. It was a half-dollar drawing with a $1 million grand prize. The Pennsylvania Lottery joined interstate drawings on June 27, 2002.

The Racehorse Development and Gaming Act was signed into law by Governor Ed Rendell on July 5, 2004. This permitted racetracks to add slots, video poker and electronic table games. It was created to help save the state's racing industry. Table games and live poker were added in January 2010.

The new table games helped Pennsylvania's gambling industry explode. The state surpassed New Jersey as the second highest state in terms of gaming revenue in 2012. Pennsylvania has retained that title ever since. Nevada is the only state with more gaming revenue than Pennsylvania.

Pennsylvania looked again to expand gambling in 2013. This time, it was over the Internet. Multiple attempts have included online poker and casino games. None has reached the assembly or senate floor for a vote.

The Pennsylvania Legislature is also looked to expand gambling to daily fantasy sports in 2016. Those talks have also failed to produce a new law regulating and taxing the contests.

Pennsylvania Casinos & Gambling FAQ

How old do you have to be to gamble in Pennsylvania?

The minimum Pennsylvania gambling age is determined by the types of gambling they want to use. Lottery and racing players must be at least 18. Pennsylvania casino players must be 21 years of age or older. Bingo players must be at least 18 unless accompanied by a parent or guardian.

Slots, video poker, electronic table games, live poker, blackjack, baccarat, Pai Gow, Three Card Poker, Four Card Poker, Ultimate Texas Hold'em, Let it Ride, Mississippi Stud Poker, Texas Hold'em Bonus and Caribbean Stud Poker are among the approved games at Pennsylvania casinos.

Yes. All seven horse racing tracks in Pennsylvania offer race books.

The only form of online gambling legal in Pennsylvania is off-track betting on horses.

Are daily fantasy sports contests legal in Pennsylvania?

State law does not cover daily fantasy sports. Sites like DraftKings, FanDuel, CBS Sports and Yahoo! claim that the contests are skilled games.

What state is the second highest in casino revenue?

Pennsylvania generates more gaming revenue than any other state except Nevada.

What games are offered by the Pennsylvania Lottery?

The Pennsylvania Lottery sells scratch-off and lotto tickets.

➝ ResearchState of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

Number of Casinos 12

Economic Impact $6.34 Billion

Jobs Supported 33,171

Tax Impact $2.48 Billion

Gross Gaming Revenue $3.38 Billion (2019)

Charities may apply for a bingo license. These cost $100 and are active for one year. Bingo games may have no prize larger than $250 for a single game except for the jackpot drawing. That bingo game may have a $2,000 prize pool. The largest amount of money that may be awarded in one day by a bingo charity is $4,000. Bingo halls may not spread more than two nights of action a week. Exceptions are made for charities that only hold annual celebrations. These nonprofit groups can hold 10 consecutive days of bingo games.

The Pennsylvania Lottery may only spread two types of games. One is instant games, sometimes referred to as scratch-off tickets. The other is lotto drawings. The Pennsylvania Lottery holds its own drawings as well as joins multi-state pools.

Horse racing is active in Pennsylvania. Seven tracks are licensed to offer live races. Each has a race book. Horse racing tracks may partner with online betting apps for remote wagering. Players may make deposits and withdrawals at the partner tracks.

The minimum Pennsylvania gambling age is 18 years of age, except for casinos, where the minimum gambling age is 21. Bingo participants may be under 18 if accompanied by an adult.

List of Pennsylvania Casinos

There are 12 Pennsylvania casinos open and currently operating. Seven are at racetracks that also offer live and simulcast betting, and the rest are casino resorts.

| Racino | Size | Address | Website |

|---|---|---|---|

| Harrah's – Philadelphia | 2,000 Slot Machines | 777 Harrah's Blvd. | www.caesars.com |

| Hollywood Casino at Penn National Race Course – Grantville | 2,450 Slot Machines | 777 Hollywood Blvd. | www.hollywoodpnrc.com |

| Lady Luck Casino – Farmington | 600 Slot Machines | 4067 National Pike | www.isleofcapricasinos.com |

| Mohegan Sun Pocono – Plains Township | 2,300 Slot Machines | 1280 Pennsylvania 315 | www.mohegansunpocono.com |

| Mt. Airy Casino – Mount Pocono | 1,800 Slot Machines | 312 Woodland Rd. | www.mountairycasino.com |

| Parx Casino & Racing – Bensalem | 3,500 Slot Machines | 2999 Street Rd. | www.parxcasino.com |

| Presque Isles Downs – Erie | 1,700 Slot Machines | 8199 Perry Hw | www.presqueisledowns.com |

| Rivers Casino – Pittsburgh | 2,900 Slot Machines | 777 Casino Dr. | www.riverscasino.com |

| Sands Casino – Bethlehem | 3,000 Slot Machines | 77 Sands Blvd. | www.pasands.com |

| SugarHouse Casino – Philadelphia | 1,600 Slot Machines | 1001 N. Delaware Ave. | www.sugarhousecasino.com |

| The Meadows Racetrack & Casino – Washington | 3,000 Slot Machines | 210 Racetrack Rd. | www.meadowsgaming.com |

| Valley Forge Casino – King of Prussia | 600 Slot Machines | 1160 1st Ave. | www.vfcasino.com |

History of Pennsylvania Gambling

Horse racing was the first form of legalized gambling in Pennsylvania. Its regulation started in 1964. The racing industry dated back more than 200 years before that. Dozens of tracks operated off the book races where the betting was handled through underground networks. It took until 1964 for the state to determine it was better off regulating and taxing the racing industry than to let it operate without any oversight.

The Pennsylvania Lottery was created by Act 91 on August 26, 1971. The first lottery ticket was sold on March 7, 1972. It was a half-dollar drawing with a $1 million grand prize. The Pennsylvania Lottery joined interstate drawings on June 27, 2002.

The Racehorse Development and Gaming Act was signed into law by Governor Ed Rendell on July 5, 2004. This permitted racetracks to add slots, video poker and electronic table games. It was created to help save the state's racing industry. Table games and live poker were added in January 2010.

The new table games helped Pennsylvania's gambling industry explode. The state surpassed New Jersey as the second highest state in terms of gaming revenue in 2012. Pennsylvania has retained that title ever since. Nevada is the only state with more gaming revenue than Pennsylvania.

Pennsylvania looked again to expand gambling in 2013. This time, it was over the Internet. Multiple attempts have included online poker and casino games. None has reached the assembly or senate floor for a vote.

The Pennsylvania Legislature is also looked to expand gambling to daily fantasy sports in 2016. Those talks have also failed to produce a new law regulating and taxing the contests.

Pennsylvania Casinos & Gambling FAQ

How old do you have to be to gamble in Pennsylvania?

The minimum Pennsylvania gambling age is determined by the types of gambling they want to use. Lottery and racing players must be at least 18. Pennsylvania casino players must be 21 years of age or older. Bingo players must be at least 18 unless accompanied by a parent or guardian.

Slots, video poker, electronic table games, live poker, blackjack, baccarat, Pai Gow, Three Card Poker, Four Card Poker, Ultimate Texas Hold'em, Let it Ride, Mississippi Stud Poker, Texas Hold'em Bonus and Caribbean Stud Poker are among the approved games at Pennsylvania casinos.

Yes. All seven horse racing tracks in Pennsylvania offer race books.

The only form of online gambling legal in Pennsylvania is off-track betting on horses.

Are daily fantasy sports contests legal in Pennsylvania?

State law does not cover daily fantasy sports. Sites like DraftKings, FanDuel, CBS Sports and Yahoo! claim that the contests are skilled games.

What state is the second highest in casino revenue?

Pennsylvania generates more gaming revenue than any other state except Nevada.

What games are offered by the Pennsylvania Lottery?

The Pennsylvania Lottery sells scratch-off and lotto tickets.

➝ ResearchState of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

Number of Casinos 12

Economic Impact $6.34 Billion

Jobs Supported 33,171

Tax Impact $2.48 Billion

Gross Gaming Revenue $3.38 Billion (2019)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2019.

Pennsylvania Gaming Control Board

303 Walnut Street, 2nd Floor

Strawberry Square

Harrisburg, PA 17106

717-703- 8300

Website

Section 1201 of title 4 of the Pennsylvania Consolidated Statutes establishes the Pennsylvania Gaming and Control Board (PGCB). The board is tasked with supervising casinos as well as slot machines at racetracks, online casino gaming and sports betting.

AVAILABLE GAMING LICENSES

Category One – Racetrack Facilities License

Category One – Racetrack Facilities, Addition of Table Games License

Category Two – Standalone Casino License

Category Two – Standalone Casino, Addition of Table Games License

Category Three – Resort-style Casino License

Category Three – Resort-style Casino, Addition of Table Games License

Category Four – Ancillary Casino License

Category Four – Ancillary Casino, Addition of Tables Games License

Interactive Gaming Certificate

Interactive Gaming Operator License

Manufacturers License

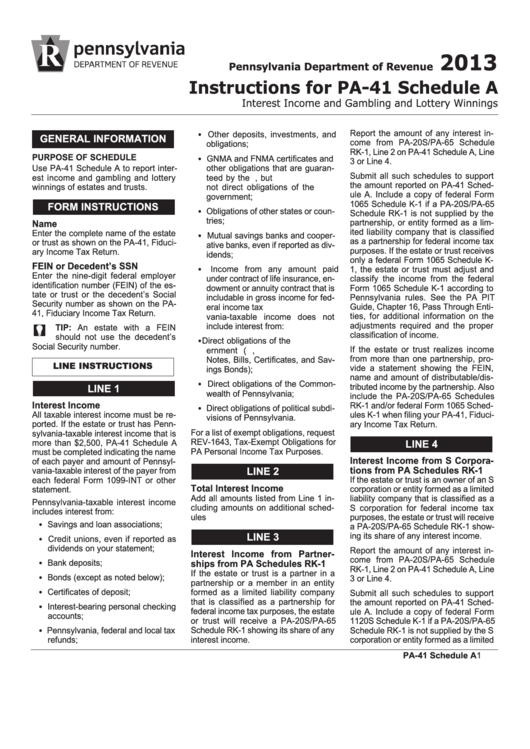

GAMING TAX RATE

Pennsylvania imposes a 34 percent tax on the gross revenues collected from slot machines. On top of this, the state has placed an additional tax of up to 12 percent for the Pennsylvania Race Horse Improvement Assessment, a 5 percent tax that will go to the Pennsylvania Gaming and Economic Development and Tourism Fund, and, finally, a 4 percent tax or $10m, whichever is greater, that will go to the host community. In total, up to 55 percent of revenues generated from slot machines will go to the government in the form of taxes.

Effective August 2016, operators will pay taxes equal to 16 percent of daily gross table game revenues, up from 14 percent. The additional two percent tax is set to expire in 2019. In addition, operators must pay 34 percent of its daily gross revenues from each table game played on a fully automated electronic table game at its licensed facility.

TAX PROMOTIONAL CREDITS

None

WITHHOLDINGS ON WINNINGS

Gambling winnings are taxable income and are taxed at 3.07 percent.

| TAX ALLOCATION |

| The proceeds of the tax on slot machine revenues from Category 1, 2, and 3 casinos is distributed as follows: |

|

| The effective tax rate for Category 4 casinos is 50 percent and is distributed as follows: |

|

STATUTORY FUNDING REQUIREMENT

The greater of $2 million or .002 multiplied by the total gross terminal revenue of all active and operating licensed gaming entities. Category Four gross terminal revenue is excluded.

SELF-EXCLUSION

Yes

COMPLIMENTARY ALCOHOLIC DRINKS

Yes

ADVERTISING RESTRICTIONS

Must contain help for problem gambling message

ON-PREMISE DISPLAY REQUIREMENT

Preapproved by Office of Compulsive and Problem Gambling

AGE RESTRICTIONS

21+ years of age on floor

TESTING REQUIREMENTS

Conducted through the Bureau of Gaming Laboratory Operations, division within the PGCB.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements and PA-specific 'suspicious transactions' report requirements for transactions over $5,000.

SHIPPING REQUIREMENTS

Notification of intention to ship into, within or out of state to Bureau of Gaming Laboratory Operations and Bureau of Casino Compliance.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

In September 2018, Pennsylvania's blanket prohibition on political contributions from those involved in the gaming industry was struck down in federal court. The opinion declared the law overly broad and unconstitutional.

CREDIT OFFERED TO PATRONS

Yes

AUTHORIZED OPERATORS

Commercial casinos, racinos & online operators

Pennsylvania Tax On Gambling Winnings

MOBILE/ONLINE

Allowed statewide

TAX RATE

36 percent

INITIAL LICENSING FEE

$10 million

Does Pennsylvania Tax Gambling Winnings

LICENSE RENEWAL FEE

$250,000, payable every 5 years

AMATEUR RESTRICTIONS

None

Pennsylvania State Tax On Gambling Winnings

OFFICIAL DATA MANDATE

None

Pa Local Tax Gambling Winnings

INTEGRITY FEE

None